Investments

The Public Trustee and Guardian operates investment common funds under section 55 of the Public Trustee and Guardian Act 1985 as an investment facility for its clients. The common funds are available only for established clients of the Public Trustee and Guardian and are not open to the general public.

The following information is provided for existing investors.

Unit prices as at 31 December 2023

The Public Trustee does not have a buy/sell spread for its funds.

Sector Common Funds

Conservative Investment Fund: | $0.9802 |

Balanced Investment Fund: | $1.0138 |

Growth Investment Fund: | $1.0941 |

Cash Common Fund Interest Rate: | 3.90% |

GreaterGood Funds

Gift Fund: | $0.8460 |

Open Fund: | $0.8267 |

Historical information

Historical Monthly Unit Prices to 31 October 2023

Historical Dividends to 30 September 2023

Performance

Recent Performance Reports

Performance Report - 30 June 2023

Performance Report - 31 December 2022

Risk model asset allocation

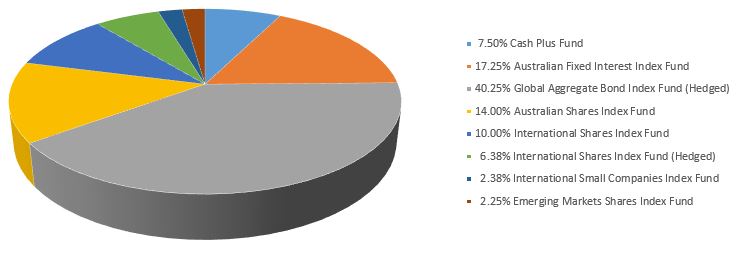

Conservative Investment Fund - 65% Defensive 35% Growth

The objective of the Conservative Investment strategy is to provide an income return with reduced volatility plus potential for some capital growth to protect the funds against inflation. It is suitable for trusts investing for short-term, trusts reliant upon income or trusts with other reasons for a conservative risk profile.

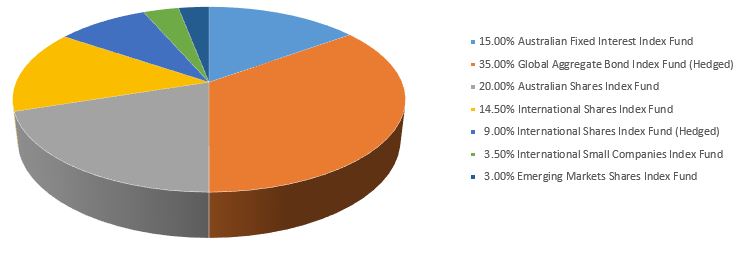

Balanced Investment Fund - 50% Defensive 50% Growth

The objective of the Balanced Investment strategy is to provide potential for higher returns through a 50% exposure to both domestic and global growth assets with a balance of fixed interest and cash to moderate volatility. It is suitable for medium term trusts or those with a mix of income and capital needs.

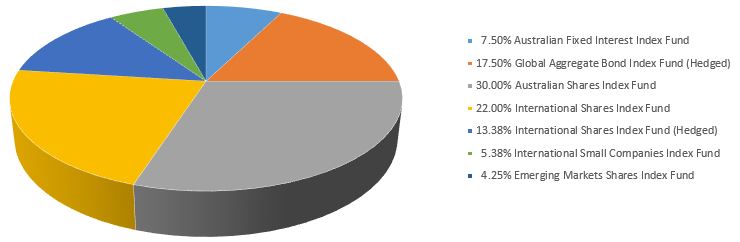

Growth and Community Foundation Investment Funds - 25% Defensive 75% Growth

The objective of the Growth Investment strategy is to attain high, long-term returns in excess of inflation. A high weighting in growth assets provides greater potential for long term benefits for trusts able to accept volatility in the short term and also provides potential taxation benefits of franked dividends and capital growth.